A rebrand is no small feat, with 950 branches across the UK, and a deadline of end 2017—this scale of change presents a tremendous opportunity to redefine the banking experience in the UK. Why is HSBC in such a rush to begin the roll out of the HSBC UK brand? Will they delight or disappoint?

HSBC is to ring fence its retail arm in the UK by 2019 to meet new laws. There has been much speculation about what this might look like for the brand and banking in the UK—a name change, a new brand, or even a new way to bank?

A completely new name, the old name ‘Midlands Bank’, and online brand name ‘FirstDirect’ were all mooted, as staff and customer research and the value of the global brand informed a decision to simply rename as ‘HSBC UK’. We all know brand is much more than a name—and imagine that HSBC will take this opportunity to redefine what HSBC and banking means in the UK.

HSBC had originally planned to launch the rebrand in 2018—but has just announced it’s now launching its first new branch in Birmingham next month.

The promise, and living up to the ambition

HSBC is a global brand—it’s hard to miss it wherever you go in the world. As an expat it was the only bank account I could get when I made the big move to London eight years ago. Of all the banks I know, HSBC’s campaigns are the ones that most clearly stick in my mind, I think because they are both provocative and ubiquitous.

The brand promise ‘powering human ambition’ is powerful and emotional—it connects people to opportunities and helps them realise their ambition. It spawned the 2015 campaign by JWT and the rich print and digital campaign that tells the stories of human ambition.

My question is this—does HSBC live up to this promise?

Does HSBC help me realise my ambitions? My online experience is fine — in my view the smartphone app and website both work well. I should however buy shares in the bank—the fees and charges I pay are phenomenal. Then there the occasional visit to the brand—it’s a whole other kettle of fish—more akin to going to the post office or dentist. In brand experience terms it’s almost as bad as you can get.

Most recently I walked into a branch to show identification for a new business account, I had to argue to convince the teller to take the information that the phone consultant had told me to provide. My next experience was to walk in to deposit cash—I had to find my way to a deposit machine, no human in sight to help me along the way or even say hello.

Transforming what it means to be a bank

During my last trip to Australia, I needed to deposit some money to a friends bank account and found myself in CUA (Credit Union Australia, what is it with banks and acronyms? I walked into a bubbly bunch gathered around a table, for a minute I had to double take, was I in a bank? I thought I was in an Apple Store or cafe. Right there and then I deposited the cash, quickly and simply with a friendly chat—I felt good, like I’ve never felt in a bank before. Interesting their slogan is ‘Life Rich Banking’.

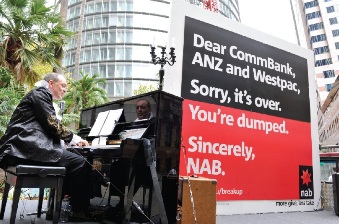

The integrated marketing campaign for nab (National Australia Bank) won the Cannes Lions for its infamous break-up with the other big banks. The new slogan ‘more give, less take’ promised to change the way banking was done in Australia—sadly, nab has not delivered on the promise and ‘More take and less give’ has been suggested as a better slogan. A rebrand and successful campaign means nothing if the brand isn’t lived from the inside out—that includes changing the behaviours of the organisation to ensure that it meets its promise.

What’s HSBC UK’s story? Are they testing the waters? Engaging their customers and their people on the journey?

The launch of the new HSBC UK brand in Birmingham signifies the beginning of the transformation. I’m of two minds whether it’s a good thing or a bad thing—it has the potential to be either.

We know that:

- The name HSBC UK is definite

- A strong global brand exists, with a promise to connect customers to opportunities and helping them realise their ambition throughout their life

- The UK brand team knows its UK customers well

- The banking experience is ripe for redefinition

There are many questions, is Birmingham simply a test? A prototype? Allowing the brand team to build along the way. Or is the brand launch being rushed for other reasons? Is this going to be a missed opportunity to really get it right? What might HSBC UK learn from other recent brand launches?

airbnb spent over a year getting their rebrand right before roll-out and they don’t have retail outlets. They went to great efforts to really understand the customer mindset and I believe have been successful on being a loved brand—of course this goes far beyond the logo—but every thing that the airbnb brand represents—it's real. The Uber rebrand on the other hand seemed to spring up out of nowhere—don't get me wrong I love the product—I'm a fan and use Uber all over the world—but my gut instinct is that this new, fussy brand is trying too hard. Has it been overthought? Over researched? Look out for my thoughts on this in another post.

Moving fast can create spontaneity and dynamism, reduce over research and over-testing and in turn produce something new and different. But in the end it comes back to brand being more than a name or a logo—the whole business needs to change it's mindset. When I walk into a branch, I want to want to go there—I want to see ambition on the face of the people that greet me—I want to really feel like my bank cares.

Is this rebrand ambitious? This is an opportunity to lead change. Time will tell as to whether HSBC UK can change both our perceptions and reality of banking—it would be nice to be able to one day say 'I love my bank' the way I might say I love Uber or airbnb.